Advanced use of Net Promoter Score

Share

Net Promoter Score℠, (also known as NPS®) is the prevalent customer sentiment metric for modern products and services, thanks largely to its simplicity and impactfulness. An indicator of customer or user loyalty, you’ll find at least some variant of the NPS at the majority of Fortune 1000 companies. But not all companies understand how to take advantage of the NPS while being aware of its limitations.

In this article, we share examples of NPS flows used by some of our clients. We also discuss the NPS’s limitations and share tips on how to overcome them.

What is the NPS?

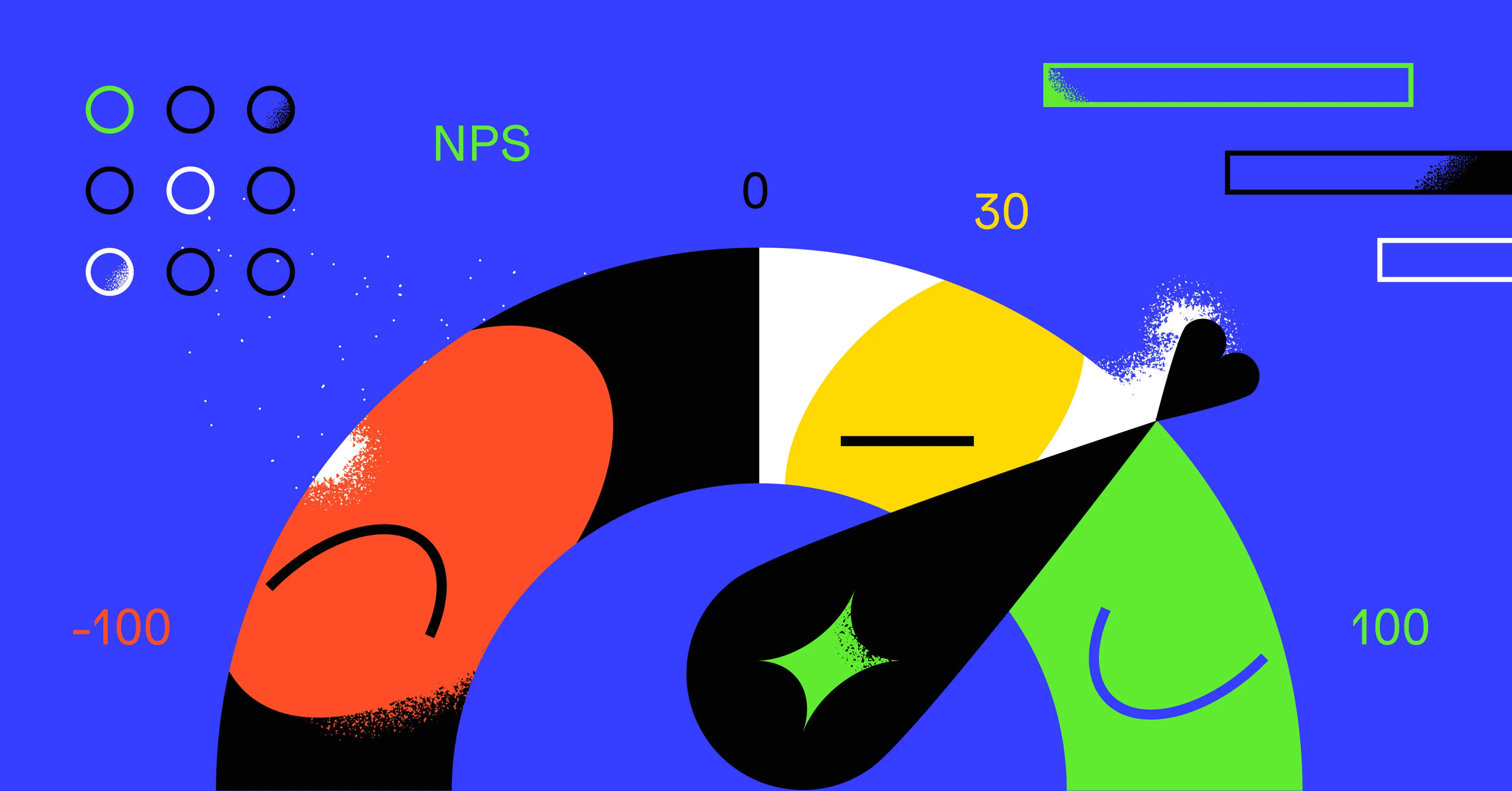

Net Promoter Score (NPS) is a measure of customer loyalty and satisfaction derived from a question about how likely they are to recommend your product or service to others on a scale of 0 to 10, created by Fred Reichheld. The range of possible values is from -100 to 100 (we’ll discuss how the NPS is calculated below). The score is industry-independent and can be used with almost any product or service.

To get an NPS for its customer base, a company will typically ask each customer a survey question like “how likely are you to recommend our offering to a friend or colleague?” The recipient would then respond with a numeric value from 0 (or 1) to 10, with the lowest value indicating most “unlikely to recommend,” and highest value representing most “likely to recommend.”

NPS is very common in all kinds of digital businesses that rely on organic growth, from service businesses and e-commerce stores to mobile apps and software-as-a-service (SaaS) applications. One of the reasons why NPS is popular among CEOs, product managers, and customer success managers is the score’s focus on measuring customers’ likelihood to promote a product or service. The more customers recommend the product to friends, the easier it is for a company to grow its user base, as word-of-mouth referrals hold a unique power in building trust and credibility for your product.

Many venture capitalists take the NPS into account when deciding whether to invest in a startup. High NPS metrics can demonstrate that users love the product offering, while a low score can be a red flag for an investment team.

How to calculate the Net Promoter Score

A typical process for getting to a final NPS of between -100 and 100 is as follows:

- Gather NPS survey responses and distribute them into buckets:

- Promoters - respondents with answers of 9 or 10

- Passives - respondents with answers of 7 or 8

- Detractors - respondents with answers of 6 or below

- Calculate the proportion of promoters and detractors from the total number of NPS responses.

For example, if a survey had 300 responses, of which 200 turned out to be Promoters, 16,5 Passives, and 16,5 Detractors, 66% of your respondents would be Promoters and 16,5% would be Detractors.

- Subtract the % of Promoters from the % of Detractors.

From our previous example, 66% Promoters - 16,5% Detractors = NPS 49,5.

Note that this way of calculating the NPS focuses heavily on promoters. Only those with the highest scores, 9 and 10, increase the overall score, and any respondents with scores of 6 or below are considered detractors. Reichheld’s 2003 Harvard Business Review article introduces the score’s concepts and explains that by employing this method, a company could focus on a key driver of profitable growth: customers who are not only happy to continue using a product or service, but who would also recommend it to their friends or colleagues.

How to calculate the Net Promoter Score

A typical process for getting to a final NPS of between -100 and 100 is as follows:

- Gather NPS survey responses and distribute them into buckets:

- Promoters - respondents with answers of 9 or 10

- Passives - respondents with answers of 7 or 8

- Detractors - respondents with answers of 6 or below

- Calculate the proportion of promoters and detractors from the total number of NPS responses.

For example, if a survey had 300 responses, of which 200 turned out to be Promoters, 16,5 Passives, and 16,5 Detractors, 66% of your respondents would be Promoters and 16,5% would be Detractors.

- Subtract the % of Promoters from the % of Detractors.

From our previous example, 66% Promoters - 16,5% Detractors = NPS 49,5.

Note that this way of calculating the NPS focuses heavily on promoters. Only those with the highest scores, 9 and 10, increase the overall score, and any respondents with scores of 6 or below are considered detractors. Reichheld’s 2003 Harvard Business Review article introduces the score’s concepts and explains that by employing this method, a company could focus on a key driver of profitable growth: customers who are not only happy to continue using a product or service, but who would also recommend it to their friends or colleagues.

Is the NPS 49,5 we calculated above a good score?

That depends on the context. Qualtrics shares their NPS benchmarks, and in their findings the top scores vary dramatically by industry. To understand the right benchmark for your company, consider inquiring with experienced consultants in the space, venture capital funds, and industry associations.

NPS: One customer loyalty metric, among many

The Net Promoter Score’s simplicity is a big reason as to why many companies have so widely adopted the prototypical “would you recommend?” question. With NPS, you can quickly get lots of data points about your customers’ sentiment, and the numeric nature of the score makes it suitable for pivot tables in spreadsheets as well as more advanced data analysis.

This simple method of using the Net Promoter Score not only helps us easily see if customers are happy but also makes it simple to compare how we’re doing over different times, with different products, or for different groups of customers. When we dig into the data more, we can find really useful information that helps us make smart decisions about what to do next. We can figure out what we need to get better at and spot patterns we might have missed otherwise.

Yet many product managers are hesitant to embrace NPS precisely because of its simplicity: it can lead to the oversimplification of the complex problem of gauging sentiment. For example, a scale of 1 to 10 might seem intuitive to a product manager, but different users might vary in their perception of a 10 (or a 1).

It is possible for a user to say they love a product in a survey, but still have their manager cancel the product’s subscription at the end of the month.

A popular Reddit thread explains that end users can find the NPS question confusing, especially when it has to do with a software product.

Regardless of the diversity of opinion about the score, industry professionals seem to agree that including an open-ended feedback field in NPS surveys works very well. Many software companies not only ask users the NPS question but also include a more generic question like, “any feedback you’d like to share?”

The extra feedback field can be a treasure trove of customer knowledge. In the context of the NPS question that comes before it, customers frequently share the reasoning for giving the product a high or low score.

In sum, NPS can be a great tool when used in combination with other customer research tools or across different user segments, so it might be unwise to use it as the only customer satisfaction metric for your software product. Let’s now look at the specific workflows that you can build around NPS.

Using NPS effectively: examples & tips

The simplest way of getting the Net Promoter Score is to regularly send out NPS surveys and look at the results. However, by implementing some more advanced techniques like creating automations around NPS, you can start seeing some serious results like achieving higher app store ratings and reducing churn.

How often to send NPS survey?

Deciding how often to send NPS surveys is about finding a balance. It’s important to stay connected with customer feelings without overwhelming them with too many surveys. Companies should think about what industry they’re in, how often they interact with customers, and the type of interactions they have. One good way is to send surveys after important customer journeys, like when they buy something, use a service, or get help. This helps gather feedback while the experience is still fresh in their minds and can show where things can be improved.

Using a regular schedule for NPS surveys, like every few months or once a year, can also work well. This gives a bigger picture of how customers’ feelings change over time. But, it’s also important not to send too many surveys. People might get tired of them and not want to respond. To avoid this, mix things up by sending surveys after different events or at different times. By finding the right balance and listening to what customers say, companies can learn more about how to make customers happier and show that they care about what customers think.

Improving customer-facing ratings in app stores

By using NPS and automating follow-up review requests based on the gathered scores, Mighty Digital helped a client recover their Android app’s rating from less than 3.5 stars on Google Play Store, to an acceptable 4.2 stars. Their ratings originally slipped due to a poor release, with the app crashing for many users. Recovering the app store rating was essential because of its importance to customer acquisition cost: customers frequently ignore an app with a rating lower than 3.5 stars regardless of the amount of marketing involved.

After the issues in the app were fixed, we used the client’s NPS process to request more app store reviews from customers who were getting a lot of value from the app. When a user selected a score of 9 or 10 in the survey, we would suggest that they review the app in the app store.

Targeting the review prompts at promoters helped us to increase our client’s app rating and significantly improve the app’s customer acquisition cost.

Understanding organic customer growth

You can likewise use NPS to understand the specific reasons as to why your users are recommending it to friends or colleagues. By grouping customer comments in the NPS survey by NPS, you can readily visualize the words customers use to describe their experience.

Getting in-depth product feedback

NPS responses are a great way to receive general product feedback, but you can take the feedback flow one step further. Product managers can use NPS to narrow down user groups with which to set up follow-up research sessions. For example, it might be helpful to talk to users who responded with a 9 or a 10 to understand your offering’s competitive strengths. But it can also be a good idea to talk to customers who responded with a 7 or an 8 to see what it would take to move them into the Promoter group.

Churn prevention

The same approach that we had advised our client to take in selecting app store reviewers can be used to prevent churn in a SaaS product. By sending out an NPS survey, you can quickly identify the customers who are prevented from using the product fully or frustrated by the user experience—they will likely be the ones responding with a very low score.

A low NPS response should be a trigger for your customer success team to reach out to the respondent user. For instance, you could send each respondent below a threshold score an offer to book a call.

Sample NPS Automation Architecture

Founders and growth marketers often wonder about how to automate a Net Promoter Score survey.

In this section, we share a reference architecture that we use with our mobile app clients. This example uses the following tools:

- The customer engagement platform Braze sends emails to customers.

- A cloud data warehouse like Databricks or Amazon Redshift holds all of the NPS survey data like customer scores by date.

- All survey results are automatically posted to a Slack channel like #nps-responses.

- An analytics stack like Looker is used to explore NPS results in detail.

Here’s how an NPS survey is sent in our example architecture:

- Braze sends an NPS survey to a group of users based on a parameter like user sign-up date.

- The NPS responses flow into a cloud data warehouse.

- Braze consumes the NPS results and chooses which follow-up message(s) to send based on various additional criteria like customer sign-up date and recent activity in the app:

- users who rated the product highly (and thus have high NPS) get a message encouraging them to review the app on App Store or G2;

- users with high scores and whose companies meet a size threshold get upsell messages offering them to talk to a salesperson;

- users with low scores get an offer from customer success to help debug any issues.

- The results of the NPS and follow-up surveys flow back into the cloud data warehouse.

- The NPS dashboard is updated with the additional data from the data warehouse. Scores and comments are also posted to a dedicated Slack channel where product managers can monitor the results and share individual messages with relevant teams if the feedback is particularly positive or negative.

Note: Net Promoter®, NPS®, NPS Prism®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Satmetrix Systems, Inc., and Fred Reichheld. Net Promoter Score℠ and Net Promoter System℠ are service marks of Bain & Company, Inc., Satmetrix Systems, Inc., and Fred Reichheld.”

How to calculate the Net Promoter Score

How to calculate the Net Promoter Score

Is the NPS 49,5 we calculated above a good score?

NPS: One customer loyalty metric, among many

Using NPS effectively: examples & tips

Improving customer-facing ratings in app stores

Understanding organic customer growth