The Power of Data in FinTech: A Comprehensive Guide to Effective Data Management

Share

Financial technology, or FinTech, has revolutionized the way we interact with and manage our finances. From mobile payment apps to robo-advisors, FinTech has made financial services more accessible, convenient, and efficient. At the heart of this transformation lies one critical element: data. Data fuels the FinTech industry, and effective data management is the cornerstone of its success. In this comprehensive guide, we will explore the power of data in FinTech and provide insights into best practices for effective data management.

The role of Data in FinTech

Data is the lifeblood of the FinTech ecosystem. It is the raw material that drives innovation, supports decision-making, and enhances customer experiences. Here are some key areas where data plays a pivotal role in FinTech:

1. Customer Insights: FinTech companies collect and analyze vast amounts of data to understand

customer behavior, preferences, and needs. This information helps them tailor their services and

products, providing a more personalized experience to users.

Example: JPMorgan Chase harnesses data to offer customers personalized financial advice. By analyzing

transaction data, they provide users with detailed spending habits and tailored recommendations,

ultimately enhancing their financial well-being.

2. Risk Assessment: Data analytics and machine learning algorithms are used to assess credit

risk, detect fraudulent activities, and prevent financial fraud. This enables FinTech companies

to offer loans and financial products with confidence.

Example: Square, a payment processing company, uses transaction data to provide loans to small

businesses. By analyzing transaction history, they assess creditworthiness and offer quick

funding to eligible businesses, demonstrating the power of data in managing risks.

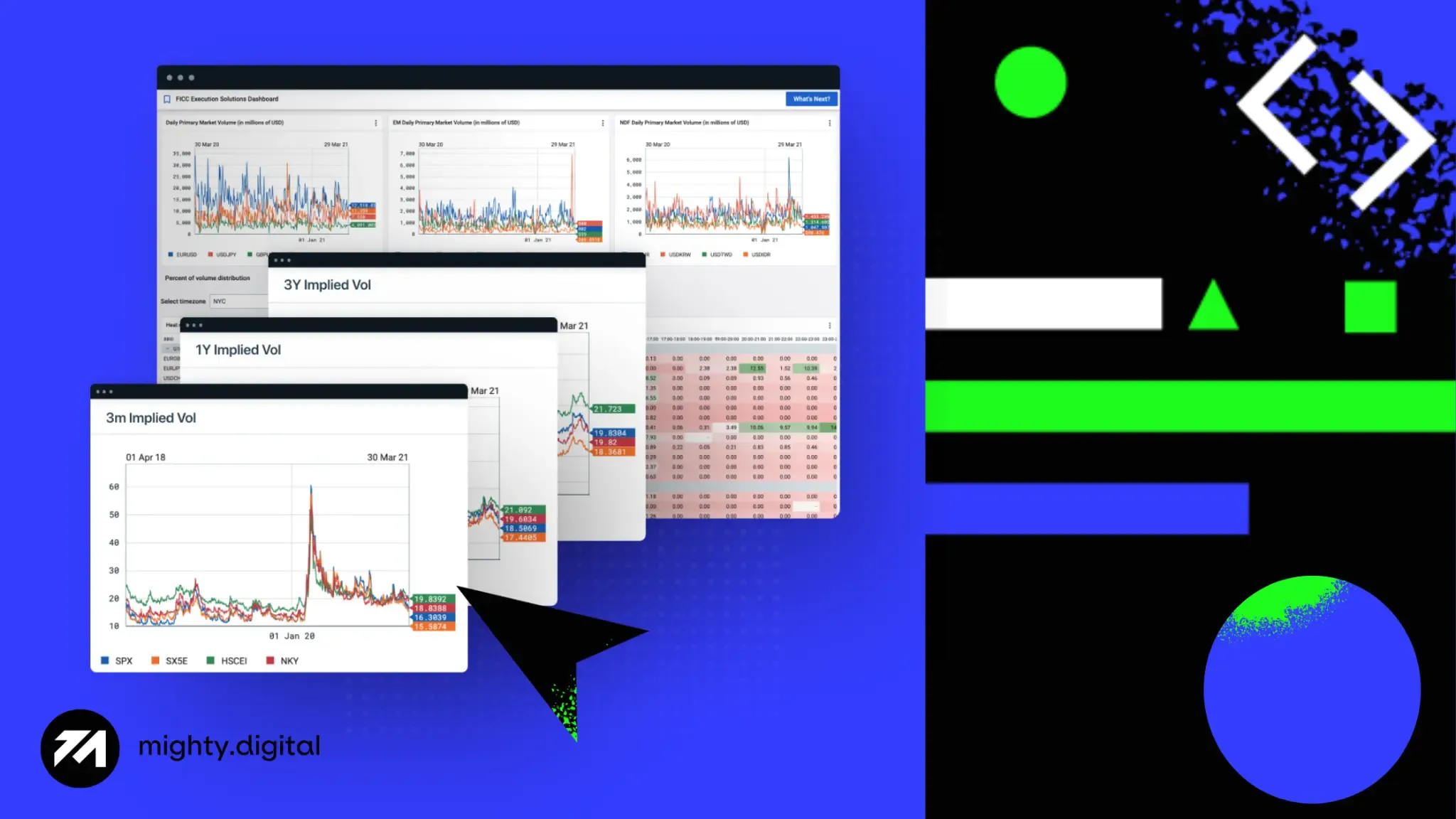

3. Investment Strategies: Robo-advisors and algorithmic trading platforms rely on data to

formulate investment strategies. They use historical and real-time data to make data-driven

investment decisions.

Example: Goldman Sachs relies on data for algorithmic trading. Their high-frequency trading

strategies are powered by vast amounts of market data and sophisticated algorithms, enabling

real-time, data-driven investment decisions.

4. Regulatory Compliance: Compliance with financial regulations is crucial in the FinTech

sector. Data management ensures that companies can track, report, and adhere to these regulations

effectively.

Example: Citibank uses robust data management practices to meet regulatory requirements. Data

analytics is employed to generate compliance reports and ensure adherence to various financial

regulations.

10 points of effective Data Management in FinTech

To harness the power of data, FinTech companies must adopt effective data management practices. Here are some key considerations for managing data in the FinTech industry:

1. Data Collection: FinTech companies need to collect and store vast amounts of data securely.

This includes customer data, transaction records, and market data. Data should be collected

transparently and with user consent.

Example: PayPal collects and stores vast amounts of transaction data securely. This data forms the

basis for their real-time fraud detection system, which analyzes transaction data to identify and

prevent fraudulent activities.

2. Data Security: Protecting sensitive financial data is paramount. Implement strong encryption,

access controls, and regular security audits to safeguard data from breaches and cyberattacks.

Example: JPMorgan Chase invests heavily in cybersecurity and data encryption to protect sensitive

customer information. Their commitment to data security ensures customers’ trust in their services.

3. Data Quality: Ensuring the accuracy and reliability of data is essential for making

informed decisions. Implement data validation processes to identify and correct errors in data.

Example: American Express places a strong emphasis on data quality. They employ data analytics to

ensure the accuracy and reliability of customer data, enabling them to design effective customer

retention strategies.

4. Data Storage: Choose the right data storage solutions, such as cloud storage or on-premises

servers, that meet your security and scalability needs.

Example: Robinhood, a commission-free stock trading app, makes informed investment decisions using

data. They carefully select data storage solutions that match their security and scalability

requirements.

5. Data Integration: FinTech systems often rely on multiple data sources. Effective data

integration is critical for creating a unified view of customer and financial data.

Example: Square integrates data from various sources to assess credit risk. This comprehensive data

integration enables them to provide loans to small businesses and support informed decision-making.

6. Data Analytics: Leverage advanced data analytics tools and machine learning algorithms to extract valuable insights from your data. These insights can drive business decisions, improve customer experiences, and enhance risk management.

7. Regulatory Compliance: Stay updated with financial regulations and ensure your data management practices comply with these regulations. Non-compliance can result in severe penalties and reputation damage.

8. Data Retention and Deletion: Define data retention policies to determine how long data should be stored. Ensure that obsolete data is securely deleted to reduce data management costs and privacy risks.

9. Disaster Recovery: Develop a robust disaster recovery plan to protect your data in case of unforeseen events. Regularly back up your data and test recovery procedures.

10. Data Privacy: Prioritize data privacy and transparency. Clearly communicate how customer data is used and give users control over their data.

In the world of FinTech, data is the currency of innovation and success. Effective data management is the key to harnessing the power of data and using it to drive customer-centric solutions, manage risks, and stay compliant with regulations. FinTech companies that invest in robust data management practices will be better positioned to thrive in this dynamic and rapidly evolving industry.